- Why David Kidder Is Building His Third Company In New York City

- How Clickable Is Borrowing From Apple’s Philosophy In Building Its Company

- The Difference Between “Cheap” Money And “Expensive” Money When Raising Capital

Full Interview Audio and Transcript

Personal Info

Hobbies and Interests: Pen and ink drawing, kids.

Sports teams: Arsenal, NY Giants.

Favourite Books:

- Code Name God by Mani Bhaumik

Favourite Entrepreneurs: Marc Andreesen, Jeff Bezos, Jacqueline Novogratz.

Twitter url: http://twitter.com/davidskidder

Personal blog: http://mykidder.com

Company website: http://www.clickable.com

Fast Track Interview

Adrian Bye: I’m with David Kidder, the CEO of Clickable. Tell us about yourself.

David Kidder: I’m founder and CEO of Clickable, which is based in New York. We’re a simple tool that takes the complexity and time out of managing online advertising across all the major networks including Google, Yahoo!, and Microsoft.

We just expanded into the social advertising space with the first Facebook integration. There are about 130 people in the company, and we’ll add about 100 people in the next 12 months. It’s growing very fast.

I have a couple of side hobbies. I have a non-profit called GoodAds. It’s a partnership with GE, NBC and Millennium Promise, which helps use corporate branding to market cause-products. From malaria nets, to inoculations, to MEDEX, we use big branding dollars to “greed what is good.” We use banner ads to move attention into purchasing or endorsing cause products that do meaningful good every single day.

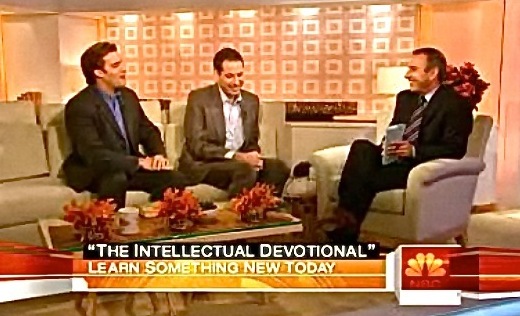

The other one is a book series I write, published by Rodale called, “The Intellectual Devotional.” It’s comprised of five-minute-a-day readings to renew your mind.

I have two boys, Jack and Steven, and we have our third child due in August of this year. There’s not a lot of sleep.

Adrian Bye: Clickable is your third company. How did your first two companies do?

![]() David Kidder: The first one, Net-X, had about 10 people. I sold that to a privately held company that was competing with PointCast.

David Kidder: The first one, Net-X, had about 10 people. I sold that to a privately held company that was competing with PointCast.

We then sold my other company, SmartRay to Lifeminders. We had about 40 people and we sold that for a little under $40 million after the dot-com crash.

Adrian Bye: Through the wild times of the dot-com era, how did that feel when you were in it? Since there wasn’t a proper financial underpinning, were people going for it or doubting it?

David Kidder: We were all pretty wide-eyed. I don’t think that people realized that we were really in the first generation of the technology. The Internet influenced so many, both privately, publicly, personally, and professionally.

Whether it be a start-up person right down to your grandmother. Everybody began touching the technology. It’s not like nanotechnology, energy, or derivative products, where only 10 people know how to do it. Everybody understood it. And, of course, the Internet birthed some very serious companies: Amazon, eBay, Google. That first phase was as much an economic hothouse as it was art hothouse.

Adrian Bye: I think Chris Anderson had said that in that first decade we had, as you mentioned, eBay, Amazon, and Google, and a bunch of others. In this following decade we’ve only really had Facebook, and potentially Twitter. There hasn’t been a ton more that has come out of the second decade compared to the first decade.

David Kidder: Chris is right in a sense. But you still have businesses that are emerging. YouTube is a transformative type of success. That was not a fluke. You have smaller, less capital-intensive businesses, that may have not moved the economic needle, but they’ve moved behavior.

Adrian Bye: Do you think you would be starting your third start-up, Clickable, today if you had been born and grew up in Nebraska?

David Kidder: I believe that location influences the growth speed of a company. You need to put yourself physically into a place, a grid of inter-networks. A graph where the connections and the relationships you have accentuate your business. New York is a great place for that. Silicon Valley is a great place for that.

Adrian Bye: Do you feel that being in New York has given you more access to more deals and info?

David Kidder: Definitely. I have invested in building very good relationships with people who are doing important work. I try to cultivate that. Again, you can’t fake that stuff. It has to be real.

David Kidder: Definitely. I have invested in building very good relationships with people who are doing important work. I try to cultivate that. Again, you can’t fake that stuff. It has to be real.

New York is media and advertising rich, and the entrepreneurial community is strong. We’re still a distant second from Silicon Valley, but the community here is vibrant. It’s growing fast, and we are probably second only to Silicon Valley. I think we will never exceed Silicon Valley. It’s just different.

I rarely have to travel. The good thing is that in this next generation of technology, with media and advertising driving these conversations, that’s all done in New York. So most of the major deals I do are in the city, which is a huge competitive advantage over the Valley. They are both expressing different types of value, but they are also unique and discreet in how they trade it. I am very bullish on New York and where it is going.

Adrian Bye: You chose to work with Fred Wilson and Union Square Ventures. Why did you pick blue chip money rather than cheaper money?

David Kidder: Well, it’s more than money. There’s advice, contacts and accountability that comes with that. I think it’s important that a board is helpful in driving the business.

Fred Wilson, Albert Wenger, and Brad Burnham at USV are incredibly pro-entrepreneur and experienced. They’ve been in this business for a long time. And they are very different from the Founder’s Fund, another one of our investors, which is comprised of young entrepreneurs. Our third investor FirstMark Capital, formerly Pequot, with Rick Heitzmann.

I would say all three of our funds understand that building companies is an art and a science. It’s difficult to do it well. They have all built, sold and operated businesses.

They are connected and have a long-term vision of building great value. They give you room to speak in the boardroom, to deploy capital and spend money well towards solving problems. I took a lower valuation to work with them. It’s better to win well with all your investors intact, believing in you, than it is to go for massive valuation and not have your investors come along.

I’m serious about how I’m building this company. We are working in concert to create the greatest economic value for everyone around the table. All the employees, the investors, and their investors. That sense of accountability drives this business.

Adrian Bye: And so that justifies a lot of valuation, because you think in the longer term the accountability will help you get there?

David Kidder: Let me just say this: it’s hard to build a company and it’s hard to sell a company. The entire marketplace, your employees, your competitors, your customers have to want you to win. The company that buys you wants to see you win, and be enriched.

David Kidder: Let me just say this: it’s hard to build a company and it’s hard to sell a company. The entire marketplace, your employees, your competitors, your customers have to want you to win. The company that buys you wants to see you win, and be enriched.

The conversations and the reputation that happen as a result of your VCs engaging with you can transform the value. It’s almost like shopping. They’re saying, “Here’s what I’ve invested in. What do you like?”

VCs don’t make a company successful. I think they help make a company make better decisions and grow faster. And that’s it. Still, at the end of the day it’s about the entrepreneurs, the culture, the product and their magic coming together at the right time in the marketplace.

Raising money? It’s a material event, but it just means you can start building. It’s not a signal that the outcome is going to be a success. It’s just empowerment.

Adrian Bye: Can you tell us a little bit about Clickable?

David Kidder: The other players in the search advertising marketplace sell complexity. Most companies describe how hard it is to do this, and then they sell solutions to that difficulty or that complexity. Or they say that their knowledge and technology is the only thing that can solve that complexity.

I did a lot of research while I was in between companies. I realized this marketplace is desperate for someone to come in and just speak the truth, transparently. I wanted to express a lot of my work experience and personal and professional interest in those areas. Create a culture that’s designed to solve those problems and to do it in a trusted way for companies.

This marketplace is huge, so there’s a lot of room to maneuver. There’s room to invent. It’s not like one answer will solve your problem. You can have lots of outcomes for the company that you can invent.

A company growing fast needs to go in and create a solution to a problem. Typically, it takes three years to really figure out what you have. You go in with a bias and you try to solve that bias. But the truth is, you need to build it backwards. You need to listen to the customer, look at that and build that. Let the marketplace rip the product out of you. And that’s what we experienced.

After about three years of working hard and solving that problem and being capitalized, you’re going to discover you are in the first iteration of the company. We’re hitting our stride, but it’s a slog. It’s complex and challenging and high risk. There are a lot of ways to fumble the opportunity along the way. But if you keep the business solving those problems, and you’re not trying to boil the ocean, you can get to the answers and create a great company.

I admire Steve Jobs a great deal. I studied industrial design and fine arts, as well as engineering. I love design and beauty in products. We try to be that. We try to create a unique, powerfully simple user experience across all these networks so that anybody can come in and experience success. We give them recommendations. We have a very sophisticated piece of technology called an ActEngine. It tells you how you’re doing and what you need to do every day, both quantitatively and qualitatively. We give them simple recommendations.

The hardest thing in the world is to do something simple. It’s easy to make things complex, add features, buttons, switches, knobs, language and words. But it’s very difficult to take those tools out and just give the answer.

Adrian Bye: And so you’ve focused on making it simple?

David Kidder: Yes. Which is very hard work.

David Kidder: Yes. Which is very hard work.

Adrian Bye: Why would I use you rather than go and manage it myself?

David Kidder: The reason why you’d use us is we save you time and defeat complexity. We’re chasing the 100,000 companies spending between $2,000 and $100,000 a month on Google today. They have so much work to do that they have Google and Microsoft Excel open, trying to develop “A Beautiful Mind,” on how to do this business well and make money. It’s actually two full-time jobs – on top of running their business.

We reduce that to 15 minutes a day and produce a greater economic return. We disrupt the complexity and we do it for you. We have one hand on the wheel, you have the other. You own your data. We give you a brand new simple experience. We set you on a new course.

Adrian Bye: You’re doing it with systems rather than with people?

David Kidder: It’s a balance of the two, but we give you tools. Our recommendations will actually tell you what to do. We would look at your data and say, “You need to change your ad campaign and the structure. Add these keywords and increase, decrease these bids.” All through a simple, three-step wizard.

We also have a program called Clickable Assist, where we’ll just do it for you. Just hand it off to our team which has the technology that allows them to do this well.

So there’s a nice balance between you having one hand on the wheel, us having the other. Or us taking full control for a period of time. The point is that we defeat time and complexity.

Adrian Bye: What’s a typical success story to come through you? Someone spending 50 grand a month and you get them up to a 150 grand a month?

David Kidder: It’s not only how much money they’re spending, it’s how effective their goals are being set. What is their goal? It could be downloading a white paper, it could be selling a product.

The conversion value, the ROI, or the effective cost per acquisition is one of the key metrics. There are lots of people selling lots of complexity. We simply ask the advertiser, “What is your goal?” And accomplish that goal.

Adrian Bye: So what’s a typical client for you guys?

David Kidder: Someone spending between $2000 and $100,000 a month in online advertising inside of Google, Yahoo!, and Microsoft. That’s not the ceiling, that’s the average. We have huge spenders and smaller spenders.

We’re definitely expanding. We’ve recently made announcements in social with Facebook. Banners, social, local, mobile, the whole thing. We want to be the Apple of ad management platforms. We want to be on the desktop of the marketer, helping them be great at this business.

Adrian Bye: Let’s say things work out really well for you and you’re growing. Who’s the sort of company that ends up buying your company?

David Kidder: First of all, there are a lot of companies in our space who could be potential owners. Every month we grow further. We are gaining momentum. We are not just building into the plan. It’s going to be leveraged and compounded growth over the next three or four months. Then who knows what is going to happen. Right now, I am not interested in an owner. I’m interested in building a great company culture. And we are living it out.

Adrian Bye: Do you see yourself retiring as a billionaire?

David Kidder: No, I don’t ever see myself retiring. I love to create and innovate. A lot of my travel in the world has influenced my belief that if we have light, space and safety, we have already won humanity’s lottery. We have a responsibility to take risks.